NEWS

AUSSIE WINE EXPORTS DECLINED 8% IN 2025 DRAGGED BY WEAK CHINA & US DEMAND

By Staff Reporter

30-1-2026

Source: Wine Australia

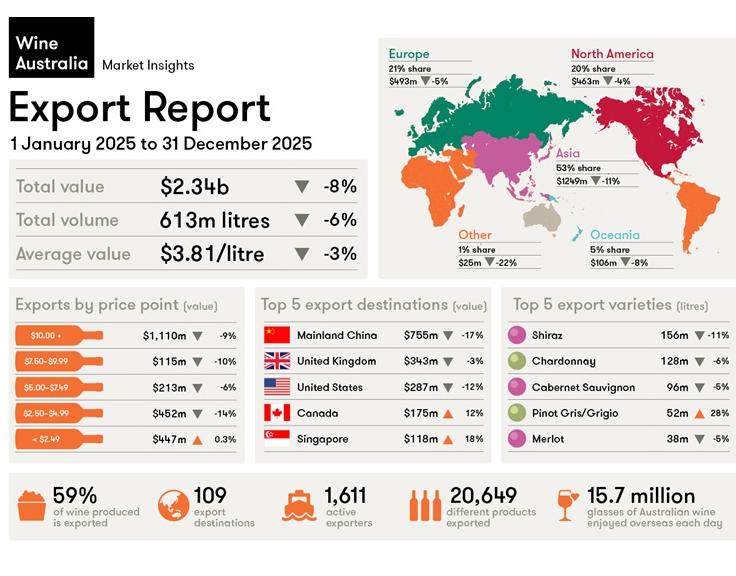

Australian wine exports declined by 8 percent in value to AUD2.34 billion (USD1.64) and 6 percent in volume to 613 million litres in 2025, according to Wine Australia’s latest export report.

The reduction in overall exports was largely driven by declines in the value of exports to mainland China and the United States (US) and in volume to the United Kingdom (UK).

However, there were markets recording value growth for Australian wine including Canada, Singapore, Thailand and Malaysia indicating areas of opportunity for ongoing market diversification.

Exports to mainland China had the biggest impact on the decline in value, as shipments to the market were down by 17 percent year-on-year to AUD755 million, following the initial restocking period after the removal of import tariffs on Australian wine.

Wine Australia Manager Market Insights Peter Bailey said the overall weakened export performance is consistent with the long-term trend of declining wine consumption in major markets around the world.

“Consumers are reducing overall alcohol consumption in line with wellness trends and in order to save money as the cost-of-living increases. For wine exporters around the world, trade barriers and regional conflicts are also making it more difficult and costly to get product into markets,” Mr Bailey said.

“While the re-opening of the mainland China market at the end of March 2024 provided some temporary relief in the decline in total exports, the Chinese wine market is one third of the size it was five years ago – impacting both domestically produced and imported wines,” Mr Bailey said.

“While shipment levels in the first three quarters after tariffs were removed were exceptionally positive, consumer demand has been subdued. Chinese consumer confidence has only made minor improvements since falling to an all-time low in 2022 during the COVID-19 pandemic, which has negatively impacted consumer spending.

“Red wine was the driver of the decline in shipments to mainland China over the past 12 months. Exports of white wine increased by 77 percent in volume, growing to a 15 percent share of export volume from 7 percent in the previous year. The top three varieties in white wine exports to mainland China – Chardonnay, Sauvignon Blanc and Riesling – all grew.”

The Asian region, excluding mainland China, increased by 1 percent in value to AUD494 million. Shipments to Singapore increased by 18 per cent in value to AUD118 million, overtaking Hong Kong for the first time since the 12 months to September 2020.

Value growth was widespread among other Asian destinations, with the largest increases coming from Thailand, Malaysia, Indonesia, and Taiwan. The important Northeast Asian markets of Japan and South Korea also grew at slightly lower rates.

More than 50 percent of the volume of Australian wine exports go to the UK and the US. These two wine markets are facing very tough headwinds, including changing consumer habits with preferences away from wine drinking occasions and increased cost-of-living.

Export value of Australian wine to the UK and US declined by 3 and 12 percent respectively. However, shipment volume to the US increased due to growth in unpackaged bulk wine shipments (to be packaged in market).

Premium wine exports to the UK also increased with shipments valued above AUD7.50 per litre growing by 15 per cent. The growth was spread across many of the key varieties, including Shiraz, Cabernet Sauvignon, Chardonnay, Grenache and Sauvignon Blanc.

Australian wine exports to Canada increased by 12 per cent in value to AUD175 million. Growth came from across the price spectrum of packaged wines as Canadian consumers look to replace American wines with other source countries following the removal of American wines from liquor board shelves.

The top five markets by value were:

• Mainland China, down 17 percent to AUD755 million,

• United Kingdom, down 3 percent to AUD343 million,

• United States, down 12 percent to AUD287 million,

• Canada, up 12 percent to AUD175 million, and

• Singapore, up 18 percent to AUD118 million.

The top five markets by volume were:

• United Kingdom, down 9 percent to 194 million litres,

• United States, up 11 percent to 118 million litres,

• Mainland China, down 18 percent to 69 million litres,

• Canada, down 2 percent to 64 million litres, and

• New Zealand, down 13 percent to 24 million litres.

(the writer can be contacted at: info@thewinechronicle.com)

ALL RIGHTS RESERVED

**IF YOU THINK THE WINE CHRONICLE IS WORTH SUPPORTING, PLEASE MAKE A DONATION TO HELP US IMPROVE AND CONTINUE OUR WORK**

TRENDING│ FOCUS│ MISSION│ ABOUT US│ CONTACT

|